The Best Broker For Forex Trading Ideas

Table of ContentsThe Only Guide for Best Broker For Forex TradingFascination About Best Broker For Forex TradingThe Main Principles Of Best Broker For Forex Trading The 5-Minute Rule for Best Broker For Forex TradingAbout Best Broker For Forex Trading

Given that Foreign exchange markets have such a big spread and are made use of by a substantial number of participants, they provide high liquidity in comparison with other markets. The Foreign exchange trading market is frequently running, and thanks to modern innovation, is available from anywhere. Therefore, liquidity refers to the truth that any individual can purchase or market with an easy click of a switch.As a result, there is always a prospective seller waiting to get or market making Foreign exchange a liquid market. Price volatility is just one of one of the most crucial variables that assist decide on the following trading move. For temporary Forex traders, price volatility is critical, given that it illustrates the per hour modifications in a possession's value.

For lasting financiers when they trade Foreign exchange, the price volatility of the market is additionally basic. Another substantial benefit of Forex is hedging that can be used to your trading account.

The Best Broker For Forex Trading Statements

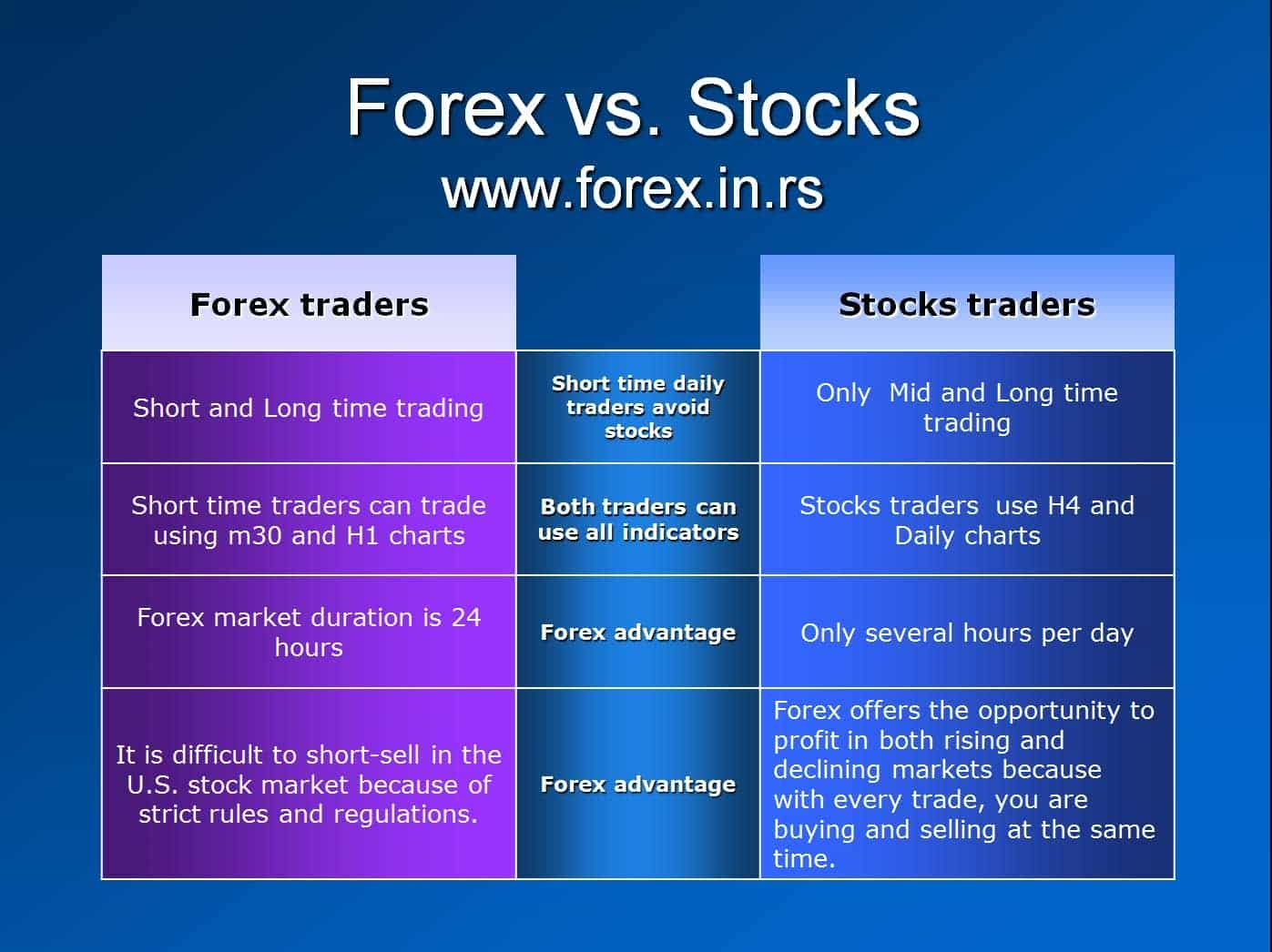

Depending on the moment and effort, investors can be divided into groups according to their trading style. Some of them are the following: Forex trading can be successfully used in any of the methods above. Due to the Foreign exchange market's fantastic quantity and its high liquidity, it's possible to go into or leave the market any time.

Forex trading is a decentralized modern technology that functions without any main monitoring. That's why it is much more at risk to fraud and various other sorts of treacherous tasks such as misleading pledges, too much high risk levels, and so on. Hence, Forex policy was created to develop a truthful and honest trading perspective. A foreign Forex broker have to abide with the requirements that are defined by the Foreign exchange regulatory authority.

Hence, all the purchases can be made from anywhere, and since it is open 24 hr a day, it can likewise be done at any type of time of the day. If a capitalist is situated in Europe, he can trade throughout North America hours and check the actions of the one money he is interested in.

3 Simple Techniques For Best Broker For Forex Trading

Many Forex brokers can offer a really reduced spread and lower or also remove the investor's costs. Investors that select the Foreign exchange market can enhance their earnings by avoiding costs from exchanges, deposits, and other trading tasks which have added retail purchase prices in the supply market.

It gives the choice to go into the market with a tiny budget and trade with high-value currencies. Some investors might not fulfill the demands of high take advantage of at the end of the transaction.

Foreign exchange trading might have trading terms to safeguard the market participants, yet there is the danger that someone may not respect the concurred contract. The Forex market functions 24 hours without stopping.

When retail investors describe price volatility in Foreign exchange, they imply exactly how big the increases and drop-offs of a currency pair are for a details period. The larger those ups and downs are, the greater the rate volatility - Best Broker For Forex Trading. Those big changes can stimulate a feeling of uncertainty, and sometimes investors consider them as an opportunity for high profits.

Some Of Best Broker For Forex Trading

Some of the most unpredictable money sets are considered to be the following: The Forex market provides a great deal of opportunities to any kind of Foreign exchange trader. As soon as having actually chosen to trade on international exchange, both seasoned and newbies require to specify their economic strategy and obtain acquainted with the terms and problems.

The material of this post mirrors the writer's viewpoint and does not always mirror the official placement of LiteFinance broker. The product released on this page is supplied for informational objectives just and ought to not be thought about as the provision of investment guidance for image source the purposes of Regulation 2014/65/EU. According to copyright regulation, this short article is taken into consideration intellectual residential property, that includes a restriction on duplicating and dispersing it without authorization.

If your firm works globally, it is very important to recognize how the worth of the united state buck, about various other currencies, can dramatically influence the cost of goods for united state importers and exporters.

3 Simple Techniques For Best Broker For Forex Trading

In the very early 19th century, money exchange was a major part of the procedures of Alex. Brown visit site & Sons, discover here the first investment bank in the USA. The Bretton Woods Contract in 1944 required money to be secured to the US dollar, which was in turn pegged to the price of gold.